FAQ

Opening a Current Account

What is Current Account?

Current Account, from your trusted credit union is a full service account that allows you to access a range of facilities, such as receiving your salary, paying bills setting up direct debits and standing orders to make regular payments. You can operate your account online and using the mobile app.

With Current Account, from your credit union, you get a dedicated IBAN (International Bank Account Number). You also get a Mastercard Debit Card with Contactless payments which allows you instant access to your money so you can make a payment or withdraw money whenever or wherever you need.

Who can apply for a Current Account?

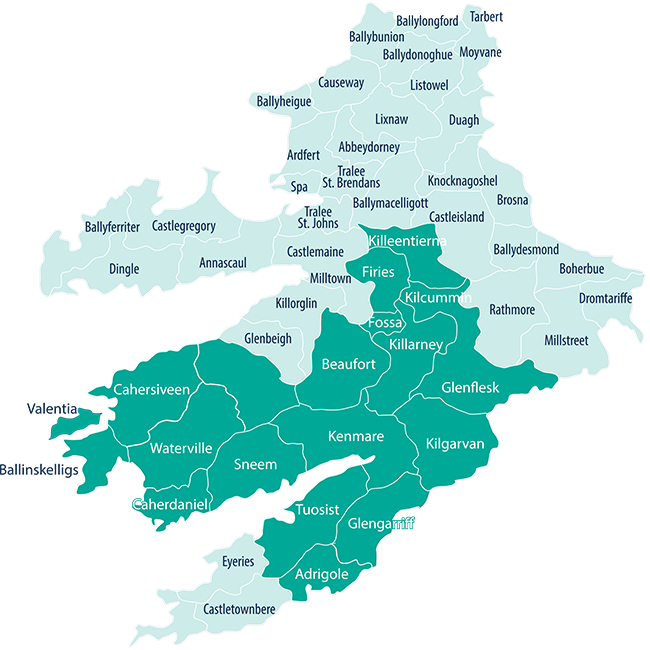

Once you are a member of a participating credit union* and are over 16 years of age, you are eligible to apply for a current account.

* Credit unions all around the country are introducing the current account service for their members. To find a credit union offering Current Account, click here.

How do I open a Current Account?

If you are registered online with your credit union, you can open a Current Account in your sole name online. Simply click here and we'll help you to open your Current Account

If you are not registered online or wish to open a joint account, you will both need to drop into your credit union office.

What documentation do I need to open a Current Account?

To open your Current Account either online or in your credit union office, you will require one proof of identity and one proof of address.

Acceptable Proof of Identity:

- Current valid signed passport/passport card

- National EU Identity Card

- Driving Licence - Full licence or learners permit

Acceptable Proof of Address*:

- Bank, building society or credit card statement (paper/e-format)

- Household utility bill (paper/ e format)

- Revenue Commissioners current balancing statement or Notification of Determination of Tax Credit/Tax Notification

*Note: These documents must have been issued in the previous six months

Can I open a joint account?

A joint account can be opened but not online. Both parties to the account must call into your credit union office with their proof of identity and proof of address to sign the application form.

How do I start using my account?

Once your Current Account is opened you will receive a welcome letter from your credit union detailing your BIC and IBAN. You will need your IBAN to arrange to have your salary, benefits or other payments paid into your account and to set up payment of bills by direct debit etc.

If you are registered for online access your Current Account is immediately available to view and use online or on the mobile app. If you are not already registered for online access, you can register or visit your local Credit Union.

Online Current Account

How do I register online with my credit union?

Credit union members can register online with their credit union on their website or by dropping into their credit union office.

Credit union office – If you are visiting your credit union office, you can register online and open your Current Account at the same time.

Website – If you register online on the website, you will be able to open your Current Account online once you receive your online Personal Identification Number (PIN). This will arrive by post within a few days of registering.

Online users can also download the Mobile App for free.

Will I be able to view my Current Account online?

Yes, once you are registered online you can:

- View your balance & account transactions

- Transfer money within your CU or externally (SEPA)

- Manage Standing Orders & Direct Debits

- Download eStatements and recent transaction reports

You will also be able to view and make quick account transfers using the Mobile App.

Using Your Current Account

How to change your home address for your Current Account?

To change your home address, you will need to provide us with proof of your new address by email, online banking via document upload, post or by calling into your credit union office.

Acceptable Proof of Address*:

- Bank/Credit Card statement (paper/e-format)

- Household Utility Bill (paper/e-format)

- Revenue Commissioners current balancing statement or Notification of Determination of Tax Credit/Tax Notification

*Note: These documents must have been issued in the previous six months

How will I get my statements?

You will automatically receive an eStatement for free on your Current Account every quarter, in April, July, October and January. If you have opted to receive quarterly paper statements, a charge of €2.50 will apply.

You also have the option to request a paper statement more frequently for a fee of €2.50 per statement.

Using your Debit Card

How many debit cards can I have on my current account?

For each sole account you open will have one card. For a joint account each account holder can have one card in their own name.

How many PIN tries do I have when using my card at an ATM or to make a purchase?

If you accidentally block your PIN at a point of sale terminal, you can simply go to an ATM and unblock your PIN.

If you accidentally block your PIN at an ATM please contact our Current Account Card Services Team on +353 (1) 6933333

What do I do if my card is lost or stolen?

Notify your Credit Union or call +353 (1) 6933333 immediately. We will then cancel your card immediately and a new card and PIN will be issued to you at your request.

How can I request a refund on my Debit Card?

Members will have 120 days to dispute a transaction on their Debit Card for the following reasons:

- Duplicated transaction

- Goods not received

- Cancelled subscription not actioned

- Received goods not as described

- Refund not processed after 30 days

- Transaction not recognised

- Free Trials

- Car Rentals

If you have identified a transaction that you are suspicious of on your Debit Card, you must contact your Credit Union or Credit Union Card Services team immediately on +353 1 6933333

A disputed transaction request initiates a 'chargeback' which alerts a request to the merchant to reverse the transaction on a Debit Card.

Members must complete and return a 'Disputed Transaction' form along with copies of any:

- Detailed cover letter advising the nature of the dispute

- Proof of purchase

- Evidence of the transaction

- Interactions with the company (emails/letters)

To be returned to their Credit Union to complete a 'chargeback' request.

What happens if my debit card is damaged?

You can order a new card by calling Credit Union Card Services on 01 693 3333 (Our rl-accordioner Services line is open 24 hours a day, 7 days a week. Calls are charged at your standard network rate. Calls from mobiles may be higher).

We will cancel your existing card and a new card will be issued to you within 7-10 working days.

Can I change my card PIN?

Yes. You can change your card PIN to something more memorable at most ATM machines. You just need to have your card available, enter your existing card PIN and follow the instructions.

Can I get cash using my card?

Yes. You can obtain cashback up to €100.00 when making purchases at participating retailers.

You can also withdraw up to a maximum of €700.00 per day at ATMs located through the country and abroad. (Withdrawal limits at ATMs vary).

Can I use my card abroad?

You can use your card anywhere in the world where the Mastercard Acceptance Mark is displayed. Foreign exchange fees and charges apply where the transaction is performed outside the Eurozone.

Can I use my card for shopping online?

Yes. You can shop at participating websites using your card. Mastercard SecureCode is a free service that provides cardholders with additional security and peace of mind when shopping online. During the checkout process when shopping online, you may be asked to register for the Mastercard SecureCode service.

Fees

What fees apply to Current Account?

As you would expect from your credit union, Current Account has simple and transparent pricing. A low monthly fee of €4.00 applies and that covers unlimited Euro point of sale and contactless transactions, unlimited mobile and online banking and unlimited standing orders and direct debit processing and up to five Euro ATM withdrawals per month. Full details of fees and charges are available here.

Will I be advised what fees I am charged?

Yes. Account fees are calculated quarterly for quarters ending 31st March, 30th June, 30th September and 31st December. A fee notification will issue along with your quarterly statement, prior to fees being charged to your account. Fees are charged to members accounts on the 28th of April, July, October and December or where the 28th is not a business day, the next business day.

Full details of all applicable Fees & Charges are available in your CU office and on the website

Personal Overdraft

What is a personal overdraft?

An overdraft is a short-term way to borrow on your Current Account and can help in months where things get a little tight e.g. if you receive a higher than expected bill and need a bit longer to pay. Once your overdraft is sanctioned, the money is available to you through your Current Account.

Who can apply for an overdraft?

Credit union members over 18 years of age can apply for an overdraft. To avail of this facility you will need to have or open a Current Account.

How do I apply for an overdraft?

You can apply for an overdraft online or at your credit union office. We will normally request you to provide payslips, bank statements, credit card statements and proof of rent payments (if applicable) for the last three months in support of your overdraft application.

How much can I borrow?

You can apply for an overdraft up to an amount equal to your monthly income, within the range of €200.00 up to €5000.00. Overdrafts are subject to normal lending criteria terms & conditions.

What term is an overdraft for?

Overdrafts are normally sanctioned for a period of 12 months. If you use your account within the overdraft limit we agree with you, then we may automatically renew it when the term comes to an end.

How much will an overdraft cost?

An overdraft facility fee of €25.00 per annum or per overdraft sanction, whichever is the more frequent, applies.

The interest rate is a flat rate of 12% per annum. Interest is only charged on overdrawn balances. Your credit union does not apply surcharge interest.