County Leagues Fixtures 2018

Chapter 23 Kerry and West Limerick Credit Union is proud sponsors of the County League Championships. Please find attached fixture list for 2018.

Chapter 23 Kerry and West Limerick Credit Union is proud sponsors of the County League Championships. Please find attached fixture list for 2018.

Why not join as a Junior Member of Killarney Credit Union this Easter. Join up and if you save for 6 weeks you could win some fantastic prizes. Read more here

Why not enter our Easter Colouring Competition, you could win a €50 Book voucher. To download here, please drop back to the credit union offices to enter.

Chapter 23 Credit Union Quiz Finals 2018

Primary school students representing the credit unions in Kerry and West Limerick put their knowledge and skills to the test last Saturday evening in the Institute of Technology Tralee as they competed in Stage 2 – Chapter Level of the All Ireland Credit Union Schools Quiz 2018. Twenty teams from Abbeyfeale, Caherciveen, Chorca Dhuibhne, Clanmaurice, Killarney, Listowel, Rathmore and Tralee Credit Unions competed. The competition was intense with the narrowest of margins separating the teams at the end of a most enthralling and entertaining afternoon. There were two competitions, A, Under 11 and B, Under 13.

The very large attendance of over 400, made up of parents, grandparents, siblings, extended family members, teachers and credit union representatives thoroughly enjoyed the evening with their knowledge of geography, history, music, literature, current affairs and credit union affairs refreshed and increased.

The aims of the Quiz are to encourage learning and teamwork among primary school pupils within an enjoyable environment. Teamwork was in clear evidence in the Institute of Technology Tralee on Saturday evening last as the members of each of the twenty teams pooled their knowledge and skills to answer twelve rounds of six questions.

The winners and runners-up of Competitions A and B (1st and 2nd placed teams in each competition) now progress to the National Finals which will be held in the RDS Dublin on Sunday 8th April 2018.

In the U11 competition Gaelscoil Mhic Easmainn representing Tralee Credit Union (Grace Ní Dhomhnaill, Iarla Ó h-Ainiféin, Ruarí Ó Loingsigh, Donnchadh Mac Uilegóid) emerged as winners with Holy Family NS Rathmore Credit Union (Liam O’Keeffe, Ross Moriarty, Eoin Cashman, Grace Murphy) in second place . Glenderry NS representing Clanmaurice Credit Union (Zara McGrath, Liam Carroll, Rory O’Halloran, Jennifer Harty) secured third place

Gaelscoil Faithleann representing Killarney Credit Union (Daire O’Briain, Adam Ó Súilleabháin, Sinéad Olibhéar, Cameron O Rua ) emerged as winners in the U13 competition following a tie-breaker with Spa NS representing Tralee C.U. (Molly Sheehy, Cian O’Gara, Cian Mason, Gearóid O’Connor)which then finished in second place. Lissivigeen NS representing Killarney CU (Shane O’Sullivan, Hannah Ryan, Oisín Dineen, Aoibhín Kelly) were in third position.

The MC for the evening, Mr Christy Killeen, thanked the Quizmaster, Mrs Helen Twomey, the adjudicators, the correctors, the stewards and the personnel from the various credit unions who helped out on the day. He thanked the IT Tralee for making their excellent facilities available at short notice and Mr Billy Donegan for providing and operating the electronic score board. He said that the scoring of the teams was very high particularly as some of the questions were challenging to say the least. The points difference between the prizewinners and the rest of the teams was minimal. He said that it was a wonderful occasion and a great learning experience for all and he complimented all the participants, their teachers and their parents on their involvement in, and contribution to, the successful outcomes of the Quiz.

Killarney Credit Union this week launched its community loan product for groups in South Kerry. The loan product is targeted at community, not for profit and charities and offers loan amounts up to €100,000 over 20 years.

Speaking about the loan, Mark Murphy, CEO of Killarney Credit Union stated “We have launched this product to coincide with recent grant aid agencies supports to community groups in our locality. A lot of groups may struggle to fundraise locally and through the provision of community finance, we can assist projects come to fruition. We offer both long term community finance over 20 years or short-term bridging finance of 6 months or less which could help in grant aid draw down” he concluded.

The credit union will consider projects from all sectors including sports groups, arts, youth activities, social enterprises and community groups. Groups, clubs and societies are all eligible to open savings accounts in the credit union which can be used for fundraising/saving activities.

Mark added “To date we have supported one local charity operating in Killarney and we are working with another club in Kenmare to develop new facilities to generate additional income. While we are cognisant that there are other social finance partners available to community groups. We would like them to consider a local lender such as the credit union as we are embedded in the local community and committed to support projects that support the socio-economic well-being of people living and working in South Kerry”.

The credit union offers a very competitive rate of 6.2%* APR on community lending and 10.5% ** APR on short term bridging finance. If any group wishes to make an enquiry in relation to a community loan, they are advised to contact Elma Culloty or Emer Guihan, our dedicated lending team on 064-6631344 or This email address is being protected from spambots. You need JavaScript enabled to view it. or make a quick loan enquiry online and the team will call you back.

1. Staff, management, board oversight, volunteers and board of directors are precluded from entry into current member draws. A Director or staff member has never won a car.

2. All our draws are held in branch and each draw is overseen by an independent external solicitor, management, risk and compliance officer who are there to ensure that the selection process is fully transparent.

3. Members have to sign up for the members draw and agree to the terms and conditions of the draw. They can withdraw at any time at their choosing.

4. Our recent winners are published on our website and in the local media. http://www.killarneycu.ie/our-services/other-services/235-members-cash-car-draws

5.The members draw is operated on a break even basis with prize funds being distributed as car and cash prizes.

6. The members draw control procedures have been reviewed by both the internal and external auditor of the credit union. No discrepancies were noted from any draw undertaken.

7. The credit union members draw prize policy is listed in the terms and conditions of members draw application form available online. Further details on http://www.killarneycu.ie/images/MEMBERS_CAR_DRAWLow_July_16.pdf

8. There has been extensive reporting on this issue and that some reports were inaccurate and misleading and that action has been taken by ILCU and the Central Bank to have these inaccuracies corrected.

If you would like to join our members draw which takes place twice a year, please complete an application form here

We wish to advise our members that the Savings Stamp service will be discontinued on the 27th February 2018. No further savings stamp books or stamps will be available for sale in branches. Killarney Credit Union are offering an alternative to our members in the form of an electronic stamp, an eStamp, on their Credit Union account which they can use for savings for bills, holidays, Christmas etc.

Why is the savings stamp service being discontinued? Unfortunately, we are no longer issuing stamps in any of the branches. The savings stamp scheme is being discontinued due to Central Bank of Ireland regulations.

What are my savings options now? The saving stamps are being replace by the eStamps account works in the same way as 'buying a stamp' - the money is lodged to a special stamp account and the member holds their own passbook showing the balance. The new estamp account will not be attached to any loan as security. These savings are fully withdrawable and are much safer than traditional stamps. The stamps are also covered by the Government Deposit Guarantee Scheme and the credit unions Life Savings Protection and would be eligible for annual dividends if declared.

What do I do with my savings stamp book?

Please return the savings stamp book and stamps (whether the book is complete or not) to the credit union. All existing outstanding stamps value will be honoured and can be converted to the new E-Stamp at any time. You can chose to redeem your stamps, pay towards a credit union loan to transfer the value to the new estamp account. You have until the 31st May to return your stamp book and stamps, after that date, stamps may not be redeemed. All returned savings stamp book will be entered into a draw to win a tablet computer from now until the end of May 2018.

What is the benefit of the eStamp account?

Your local credit union in association with Radio Kerry are giving away €1,000 starting Monday 12th February. All you need to do is listen in and guess the magic number. Dont let the credit card blues get in the way, talk to Killarney Credit Union about a loan to consolidate your credit card debt, we have lots of loan options for you.

To make a quick loan enquiry click here

To find out how much your loan will cost here

1. Shane O Sullivan

2. Hannah Ryan

3. Oisin Dineen

4. Aoibhin Kelly

1. Daire O Briain

2. Adam O Sulleabhain

3. Sinead Olibhear

4. Conor Sowerby

1. Finn Kennelly

2. Roan Daly

3. Philip Lyons

4. Olivia Gaffey

1. Craig Leggate

2. Luke Courtney

3. Paddy Moore

4. Norah McGlynn

1. Rachel O Loughlin

2. Dimitris Charakampakis

3. Fionan O Sullivan

4. Eanna Coffey

1. Aoife McClarence

2. Sean O Leary

3. Max O Gara

3. Kevin Looney

1st and 2nd place winners will now go on to complete at the Chapter 23 Level of the Schools Quiz on Sunday 4th March at Ballyroe House Hotel, commencing at 2.00 pm.

€25,000 windfall for winners in Killarney Credit Union members draw

A delighted Ulick O Sullivan, a native of Farranfore got a surprise call last week when he was notified that he had won a brand new car in the Killarney Credit Union members draw.

Ulick who is now resident in Dublin collected a brand new Ford Fiesta from Pat Sheehan, Board Chairman at a prize giving ceremony at the credit union on Saturday 20th January.

Speaking about the members draw, Karena McCarthy, Killarney Credit Union Marketing Officer stated “we currently have over 2,500 members in the draw which is held twice a year. This year our prizes included a new car and prizes ranging from €250 to €1,000 cash, our next draw will take place in July 2018” she concluded.

Members can apply for the members draw at any of the branches or download an application form online www.killarneycu.ie. €12 will be taken from your account twice a year as an entry fee for the members draw.

The cash prize winners were Mary Quirke, Connie Brady, Joan Mulchinock, Tim O Sullivan,

Mary Mulcahy, Noreen O Donoghue, Julia Casey, Denis Cronin , Annette Sheehan, Eileen O Shea, Olive Sheehy, Julie Payne, Mary T O Sullivan.

Karena added “The draw is limited to members of Killarney Credit Union and anyone over the age of 18 can apply to join, so we would encourage members to sign up, if they haven’t already, as the saying goes, if you’re not in, you can’t win” she concluded.

Killarney Credit Union Chairman Pat Sheehan, left, presents the keys of a new Ford Fiesta car to Ulick O' Sullivan, Farranfore, winner of the Killarney Credit Union Members Car Draw. Also included on right are Pat Delaney, Killarney Credit Union and Dermot Moriarty, Killarney Autos

At the presentation of the Killarney Credit Union members draw cash prizes were front from left, Killarney Credit Union Chairman Pat Sheehan, Mary Quirke and Pat Delaney Killarney Credit Union. Back from left are Mary T O'Sullivan, Connie Brady, Annette Sheehan, Tim O'Sullivan, Joan Mulchinock, Denis Cronin and Julie Payne

If you want to join the members draw, complete form and return to the credit union

16th January 2018

Car loan or PCP? How should you fund your 2018 car purchase?

Consumers in Ireland are changing their cars more frequently than before and this trend is set to continue in 2018. The latest Carzone Motoring Report (2017) says that one in two people now change their car every five years, and 60% are planning on buying either a new or used car in 2018. With so many set on a new pair of wheels in the coming months, it’s likely that a lot will struggle to decide between a traditional car loan or a Personal Contract Plan (PCP) to help finance the purchase.

For many, headline rates on PCP agreements can at first look more attractive, but these can easily distract from the range of additional charges and a good deal of inflexibility. Essentially PCPs are lease schemes. The buyer has in effect, hired the car for a particular period of time, usually 3-5 years, while they make payments. At the end of the agreement, they will have to make a balloon payment in order to own the car.

In addition, they will need to be conscious of the mileage they are racking up, because the balloon payment, or guaranteed minimum future value (GMFV), of the car will have been calculated with their annual mileage in mind.

In contrast, with a credit union car loan, the consumer simply borrows the money to pay for a car, which they own immediately, and they can drive as much as they please. They can also sell the car on at any time they wish, should they need to, whereas they do not have this option with a PCP.

Killarney Credit Union is reporting a recent increase in queries about car loans, which could be down to weaker sterling fuelling the increase in cheaper used car imports from the UK, along with media coverage of the inflexible nature of PCPs.

“There appears to be a renewed interest in the traditional car loan due to greater flexibility and more straightforward terms and conditions” Helen Courtney Power continued. “We would encourage anyone considering buying a new or used car in 2018 to pop in or call us at Killarney Credit Union before making any decisions. We are happy to see all our members, no matter how long it has been, and of course we are always happy to chat to anyone who has never been a credit union member.”

Speaking in more detail about the differences between car loans and PCPs, Helen Courtney Power, Business Development Officer, Killarney Credit Union said: “If you arrange finance with your credit union before going shopping for a car, you are in a much stronger position. You are effectively going as a cash buyer to the car dealer, and may well be able to negotiate a better deal. At Killarney Credit Union we offer a car loan with an APR rate of 7.8%* and we also offer car insurance, through the credit union insurance website coveru.ie. Our loan is typically approved within 48 hours.”

Killarney Credit Union has also put together a checklist for anyone considering a PCP agreement before they sign the dotted line:

• Be aware that to extend the term of a PCP you may be charged a rescheduling fee.

• Take note of the cap on the number of miles/kilometres you are allowed to clock up over the period of the contract.

• You may be requested to commit to certain car servicing agreements.

• Ensure you always enquire about additional fees and charges, you are entitled to a list of all additional charges so ask the garage for this before you sign any agreement.

For more information on PCP's and how they work check out www.consumerhelp.ie/pcp

-ENDS-

* For a €5,000, 2 year variable interest rate loan with 24 monthly repayments of €225, an interest Rate of 7.49%, a representative APR of 7.8%, the total amount payable by the member is €5,399.86. Information correct as at 16/01/18

Firstly, many congratulations on getting engaged, while this can be a very exciting time for any couple, it can also cause a major financial strain on both partners. The average cost of a wedding (including a honeymoon) in Ireland costs €24,427 (Source: WeddingsOnline, Jan 2017). Here are some top tips from your local credit union to help get prepared for your big day and avoid some financial pitfalls.

Top tip #1 Prepared a wedding budget (and stick to it!)

The first thing you should do to prepare for your wedding is to discuss the wedding budget with your partner. A useful tool is the wedding budget planner on the Competition and Consumer Protection’s consumer website. It will help you calculate all costs, big and small. It will help you to prioritise your spending, helping you decide what is really important for you on the big day and what can be cut.

Top tip # 2 Keep saving (even after the wedding!)

Identify any current savings and decide on a regular amount that you can afford to put aside on a regular basis until your big day. Why not open a joint account in the credit union (if available in your credit union) and start saving. You should try and save as much of the wedding costs as you can in advance and minimise the amount you need to borrow. If you are lucky enough to receive cash gifts for your wedding, why not lodge them into the credit union also, a safe place your money, where you can access when you want.

Top tip #3 Clear debts

Try and clear as many debts as you can such as credit cards, overdrafts, personal loans etc before you start saving. Starting married life with debt can create a headache for both partners as additional costs such as mortgages, education or childcare may occur in the future.

Top tip #4 Keeping account of your wedding spending

Once you have set your budget and start to purchase items for your wedding, it is a good idea to keep track of your spending to ensure you stick with your budget. There are several wedding budget apps available online or alternatively use an Excel spreadsheet to keep a record.

Top tip #5 Borrow wisely

If you are borrowing for your wedding, compare rates from all the financial providers. Many credit unions offer specific wedding loan products with competitive rates. They may also offer short term bridging finance to cover costs until wedding cash gifts are received. Borrow as little as possible and don’t be tempted to spread the payments too far into the future. This will cost you more in interest and could have an impact on your future plans. Avoid putting wedding expenses on credit cards and overdrafts as the APR on this type of finance can be high. By borrowing from the credit union you benefit from free loan protection, no hidden fees or charges and flexible repayment terms. Your local credit union has your best interests at heart, so try and support them as much as possible. For information on credit unions locally see www.creditunion.ie.

Top tip #6: Insurance (of all types!)

Consider taking out wedding insurance as it offers you more security if something does go wrong -such as cancellation, or a trader failing to deliver a service. Many insurance providers offer wedding insurance so make sure you know what the policy covers and compare costs before you buy.

If you are planning a honeymoon of a lifetime, ensure that you have all the cover you need when it comes to travel insurance. The credit union in partnership with Coveru.ie can offer competitive travel insurance rates that are exclusive to our members and will make sure you have the right level of cover for your honeymoon.

Top tip #7: After the wedding

If you are changing address or moving house after the wedding, make sure to bring your new address identification into the credit union (a utility bill, bank statement, revenue document etc). If you wish to change the name on the account from maiden name to married name (bring in marriage certificate also) and photographic ID such as a passport or drivers licence.

For information on Wedding Loans

For information on opening a joint account here

Killarney Credit Union held its Annual General Meeting on Tuesday 12th December in the Gleneagle Hotel, Killarney at 7.30pm. The The credit union which is now serving the needs of over 25,000 members was attended by 120 people has been in existence since 1970 and has seen strong growth in the past 12 months.

Mark Murphy, CEO of Killarney Credit Union stated “The assets at the credit union now stand at nearly €109 million. In the past year, we facilitated the people of Killarney & Kenmare with over 2,440 individual loans to a value of €13.9 million”.

With the initial signs of economic recovery in the local economy, member’s confidence has seen a saving increase of €3 million bringing total savings in the credit union to €94 million. The credit union has seen consistent demand for its online banking service where members have full online access to their account to make account transfers and pay bills. The credit union also introduced a range of new loan products including a first time borrower loan, an asset backed loan and a community loan.

Mark added “there is strong demand for the development of new products such as electronic banking services. The credit union has recently been approved by the Central Bank of Ireland to offer a personal current account service which would offer an overdraft facility, contactless debt card and Apple/Android mobile phone payments.

The credit union has been heavily involved in sponsorship of local clubs, societies and charities in the past 12 months with over 40 groups receiving €20,000 in sponsorship. The credit union has an ethos of supporting local initiatives.

Pat Delaney, Chairman of Killarney Credit Union stated “We are proud of the role we continue to play in being more than a financial institution but a valuable resource to the South Kerry community and its people. While modest, we are delighted to offer our members a return on their savings by paying a dividend this year. We would like to thank all of our members for their continued loyalty and support of our services” he concluded.

Mr Delaney steps down as Chairman of the board since his appointment in 2013; he acknowledged the hard work of his fellow directors and will remain on the board of directors for the next year. Pat Sheehan, a Killarney based solicitor was elected the new Board Chairman of Killarney Credit Union.

Pat Sheehan, Chairman of Killarney Credit Union

![]()

Annual General Meeting takes place on Tuesday 12th December in the Mangerton Suite, Gleneagle Hotel at 7.30pm. Please bring passbook for ID purposes. Raffles, light refreshments served on the night. If you are travelling from Kenmare, please note a complimentary bus departs from credit union Kenmare at 6pm, please book on 06431344 before the 8th December.

Killarney Credit Union received four international awards for excellence last weekend (Saturday 25th November) at an awards ceremony in Bloomsbury, London. The credit union were the recipients of awards from the International Credit Union Leadership Development and Education Foundation.

They were the category winners in the Edward Filene Credit Union Awards for Excellence -Great Britain and Ireland. They were outright winners in the category “Engaging in community outreach and mobilisation” and in the category “Serving as a financial incubator for seed, small and medium sized businesses”. They were runners up in the category “Use of the Media”. They were award a special award for Film Production on the night.

Speaking about the awards, Pat Delaney, Chairman of Killarney Credit Union stated “it is wonderful accolade to receive these awards from the International Credit Union Leadership Development and Education Foundation. We are honoured to be recognised for our efforts as a credit union by a panel of international business and credit union experts. The adjudication process was comprehensive in nature and it is wonderful to be recognised for credit union excellence in both the UK and Ireland” he concluded.

Previous winners of the Edward Filene Awards were Glenamaddy Credit Union in Galway, there has been no other Irish credit union winner since 2011. In attendance was representatives from credit unions throughout the world including the United Kingdom, Philippines, Australia and United States who received awards as Development Educators for credit unions.

The Guest of Honour and Keynote Speaker was Marlene Shiels, O.B.E., F.C.I.B.S.(Hon), I-CUDE, Chief Executive Officer of Capital Credit Union Ltd, Edinburgh who has recently been invested with the “Order of the British Empire” (OBE) by Her Majesty the Queen; it is believed she is the first credit unionist to be so honoured.

In presenting the award for Performance Excellence for a Credit Union serving as a financial incubator for seed, small and medium enterprises operated by credit union owner-members, the judge stated

“Killarney Credit Union is a powerhouse of social enterprise and community social and economic empowerment, passionate evangelists for what they do, and so has become the winning credit union for performance excellence in lending to owner-members to develop their businesses. They added “As someone long involved in the alternative business finance sector, I can only be impressed by the professional standard and legal compliance of this business growth and bridging loan initiative, which never loses its focus on supporting the local community. The financial capability is there, behind the scenes, and the entrepreneurial spirit of the credit union shines through” they concluded.

In presenting the award for Performance Excellence for Engaging in community outreach and mobilisation by a credit union, the judges stated

“Killarney Credit Union is an extraordinary credit union”. They added “Sport is an integral part of the Irish psyche, so this simple but effective method of tapping into the competitive nature and local loyalties has reaped great rewards” they concluded.

As runner up in the “Use of the Media” category, the credit union was recognised for its use of social media and website for engagement with its members and communicating relevant messages to its target audience.

Representing the credit union on the night were Pat Delaney, Chairman of Killarney Credit Union, Stephen Darmody, Financial Controller and Helen Courtney Power, Business Development Officer.

Pat Delaney added “we would like to thank the Foundation for these awards and are proud to bring home the awards back to South Kerry and proudly display them in our 3 branches” he concluded.

l-r Helen Courtney Power, Business Development Officer, Pat Delaney, Board Chairman and Stephen Darmody, Financial Controller, Killarney Credit Union with their winning awards in the Edward Filene Credit Union Awards for Excellence -Great Britain and Ireland at an awards ceremony in Bloomsbury, London on Saturday 25th November 2017.

Photo 1: Helen Courtney Power, Business Development Officer, Killarney Credit Union accepting the award on behalf of Killarney Credit Union in the Edward Filene Credit Union Awards for Excellence -Great Britain and Ireland from Marlene Shiels, O.B.E., F.C.I.B.S.(Hon), I-CUDE, Chief Executive Officer of Capital Credit Union Ltd, Edinburgh at an awards ceremony in London on Saturday 25th November.

For more information on the foundation: http://www.iculdef.org

Press Release

21ST November 2017

Celebrating local artistic talent with prize giving ceremony

Killarney Credit Union held their presentation evening for the winners of its Art Competition on Friday night 17TH November at its head office in Beech Road.

There was a large attendance at the event where winners from the Under 7 to Over 18 category were presented with an award certificate, cash prizes and gift bags.

Speaking about the event, Joy Clifford Vaughan, Youth Officer from Killarney Credit Union stated

“There was a huge entry this year and we would like to thank all those schools throughout South Kerry who participated in the competition. This year, we had winners from Lissivigeen National School, Gaelscoil Faithleann, Anabla National School and Kerry Parents & Friends. With a theme of “Set your imagination free” this year allowed for great creativity and interpretation” she concluded.

Pat Delaney, Chairperson from Killarney presented the prizes to the following:

Under 7 Category

1st: Hudson Keogh, Headford, Killarney Lissivigeen NS

2ND: Sean Horan, Deerpark, Killarney Lissivigeen NS

3rd: Dara Horan, Deerpark, Killarney Lissivigeen NS

8-10 Category

1st: Roisin Morris, Glenflesk Lissivigeen NS

2nd: Daniel Cronin, Ballyhar Gaelscoil Faithleann

3rd: Amelie Counihan, Glenflesk Lissivigeen NS

11-13 Category

1st: Mia Counihan, Glenflesk Lissivigeen NS

2ND: Olwyn Evans, Kilcummin Anabla NS

3rd: Isabelle O Connor, Deerpark Lissivigeen NS

18+ Special Category

1st: James O Shea, Kilgobnet Kerry Parents & Friends

2nd: Martina Maher, Kilcummin Kerry Parents & Friends

3rd: Roger McCarthy, Killarney Kerry Parents & Friends

The 1st place winners of each category will go on to represent themselves and their schools at Chapter 23 Kerry and West Limerick Credit Unions Regional Level on Saturday 2nd December in the Manor West Hotel at 2pm. The first place winners will then go on to represent Chapter 23 at the national finals in Dublin.

Now in its 34th year, the competition attracts up to 50,000 entries through 300 credit unions nationwide and caters for all ages, with categories ranging from under 7 to over 18 and adult. There is a special category for those with physical and intellectual disabilities.

{gallery}Art Competition 2017{/gallery}

€4,000 giveaway in Third Level Educational Bursary Award Scheme

13th October 2017

Killarney Credit Union made a cheque presentation to the lucky winners of the Third Level Educational Bursary Award at a function at in the Beech Road office on Friday 13th October.

The winners of the bursary were Paul Murphy, Rosha Courtney, Fianait O Donoghue and Micheal McCarthy (his brother Eoghan accepted on his behalf) who each received an award for €1,000.00 each.

Speaking about the awards, Joy Clifford Vaughan, Youth Officer, Killarney Credit Union stated “in light of the increasing costs of attending third level, we are delighted to support these first year students as they begin their academic journey and also wish all those that applied continued success in their studies”.

Nearly 50 applications were received for the awards and applications were open for those who are attending third level for the first time and members of Killarney Credit Union.

The winning students were Paul Murphy from Beaufort who is studying Medicine in Trinity College, Rosha Courtney from Fossa, who is studying International Business with Spanish in Cork Institute of Technology, Fianait O Donoghue from Killarney who is studying Multimedia in St Johns Central College in Cork and Micheal McCarthy from Kenmare who is a studying Engineering in Cork Institute of Technology,

“Supporting education is very important to us in the credit union and we have given out €16,000 to date to students attending third level through our involvement in the bursary award” stated Pat Delaney, Chairman, Killarney Credit Union.

l-r Eoghan McCarthy accepting for his brother Micheal, Fianait O Donoghue, Pat Delaney, KCU, Rosha Courtney, Paul Murphy, Joy Clifford Vaughan, KCU

Credit unions have earned the number one spot for the best customer experience in Ireland again. Killarney Credit Union joins 270 other credit unions across the Republic of Ireland in topping the 2017 CXi Ireland Customer Experience League Table for the third year in a row.

The annual survey, carried out by Amárach Research for CXi, asks consumers to rate their experiences of 170 brands across 10 different sectors. Over 42,000 customer experiences were evaluated and credit unions again emerged as the overall winners, being rated highest for integrity, empathy and for the commitment of their staff. They were also singled out for the powerful bond forged with members - and the fact that the relationship with members was built completely on trust.

The CXi noted in its report that the products and services offered by credit unions are designed with the needs of their specific membership in mind, and said that credit unions were ‘the perfect example’ of organisations that ‘genuinely care’ about their members. The report also said that trust is a hugely important factor in the rankings, and that credit unions are one of Ireland’s ‘most trusted brands.’

There was a notable gap in the performance between credit unions and the banks. The highest ranking banks were Ulster Bank and AIB in 89th place.

Commenting on the great achievement by credit unions, Head of Marketing and Communications with the Irish League of Credit Unions, Emmet Oliver said: “Our members are our number one priority and each and every credit union endeavours at all times to deliver the highest possible standard of service for them. Credit unions are different from other financial institutions, not just because we are not-for-profit, but because decisions are made at a local level, allowing credit unions a good deal of flexibility to provide services that are tailored to the individual needs of members.”

Also speaking about the accomplishment, Mark Murphy, CEO of Killarney Credit Union said “We are proud to be part of a movement that is regarded so highly across the country for customer experience. Killarney Credit Union has always provided the highest standard of member service, because we genuinely care about each and every one of our members. We have forged a strong bond with our members – a bond that is built on trust. We have always put our members first and we will continue to do so.”

Delighted to be part of the Halloween Howl 2017

Colouring Competition is taking place in the Kenmare branch of the credit union, where you can win some fantastic prizes.

We have a great line up of events planned for International Credit Union Day. Keep a look on on our social media feeds for all the latest news.

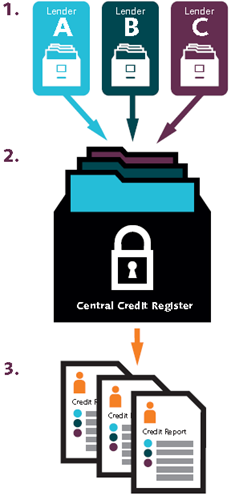

Members will shortly be recieving letters in relation to the Central Credit Register. Information on your loans over €500 will be uploaded to the Central Credit Register database.

The Central Credit Register is a national database that will, on request, provide:

a borrower with an individual credit report detailing their credit agreements;

a lender with comprehensive information to help with credit assessments; and

the Central Bank with better insights into national trends in the provision of credit.

The Credit Reporting Act 2013 requires us to process your personal and credit information for the Central Credit Register. From 30 June 2017, we will submit personal information to the Central Credit Register that we may already have about you, like:

your name;

address;

date of birth; and

personal public service number (PPSN) – a very important piece of information for matching.

The Central Credit Register needs this information to make sure it accurately matches your loans, including loans that you may have with other lenders. Producing a full and accurate credit report is one of the main aims of the Central Credit Register. We will also submit credit information each month about your loans, if the loan is for €500 or more.

Your loan information will be stored securely on the Central Credit Register where it will be used to create your credit report. The Central Credit Register will not calculate a score or grade for your credit report. Information will be kept on the Central Credit Register for five years after your loan is paid off.

In early 2018, credit reports will become available from the Central Credit Register. Once available, you may request your report at any time and are entitled to one free report each calendar year.

Lenders may only access your credit report:

when considering an application for a new loan;

if you ask to change the terms of a loan; or

if they are reviewing a loan in arrears.

Employers, landlords, or any other person or entity cannot access your credit report without your written consent.

You do not need to take any action. We will shortly begin to send information on your loans to the Central Credit Register.

We invite you to read the Central Credit Register Consumer Guide

If you have any other question about any of your loans with us, you can contact us at (064-6631344)

We are now accepting entries for the Credit Union Art Competition 2017. The theme of this years competition is "Set your imagination free". Closing date for the competiton is Friday 20th October. Please read the terms and conditions carefully for entry. Completed entries are accepted in all branches.

At Killarney Credit Union we are proud to offer some of the best rates available for a wide range of loans. Here you can use the handy loan calculator to quickly get an idea of the cost of a loan.

Simply enter the amount you wish to borrow (for example '€5,000') then choose the type of loan you want and select how long you wish to take the loan for.

Information is correct as at March 2021.

Fast approaval

Great rates

Local service

Flexible repayments