For larger loans the credit committee may insist on other security such as assignable insurance policies or a legal charge on property. Guarantors may also be sought by the credit committee, should the member fail to repay the loan, there are a legal obligation on the guarantor to repay the loan himself or herself.

A credit agreement, once signed, is a legally binding contract between the member taking out a loan and Killarney Credit Union. The agreement contains the terms and conditions under which the loan will be issued and under which it must be repaid by the member. By signing the credit agreement, a member agrees to be bound by its terms and conditions.

Killarney Credit Union offers treble the protection on your savings.

- Irish Government Protection Scheme up to €100,000 per account

- Irish League of Credit Unions Savings Protection Scheme

- Killarney Credit Union’s own strong Reserve Fund.

Credit Unions in the Republic of Ireland are covered by the Deposit Protection Scheme which is administered by the Central Bank of Ireland. This is a scheme that can provide compensation to depositors if a credit institution is forced to go out of business. It covers deposits held with Banks, Building Societies, and Credit Unions. Please see the Central Bank of Ireland’s website for further information.

In addition to this, the Savings Protection Scheme (SPS) owned and operated by the Irish League of Credit Unions is also available to proactively intervene to protect members’ savings by making available financial assistance to help any Credit Union which may experience difficulties.

Also, members’ savings are insured through Life Savings Insurance (subject to certain terms and conditions).

- Shares and Deposits can be withdrawn on demand provided they are not held as security against a loan.

- Shares and Deposit withdrawals can be made during office hours.

- Please bring photo identification when making a withdrawal.

- There may be limits of withdrawal amounts, if you wish to make a large cash withdrawal, please let us know in advance, so to have the adequate cash ready for collection.

As the amount of shares builds up, the common fund of money grows. This is then available for providing loans to members. All members are encouraged to save regularly, even when repaying a loan. This gives the member several direct benefits, and ensures that there are funds for the credit union for use by all members.

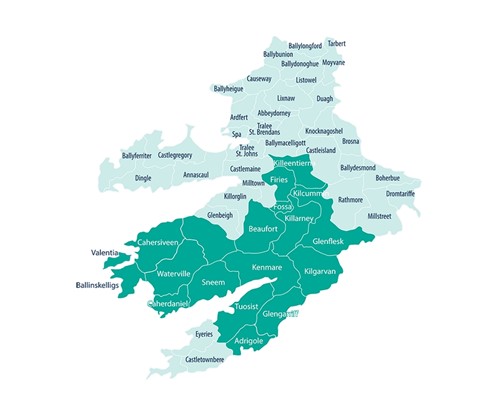

Provided that you meet the membership criteria of living or working within the common bond area of Killarney Credit Union Ltd you can transfer your savings and keep your savings history. You can also transfer your loan – subject to approval by the Credit Committee and continue to pay the loan balance at Killarney Credit Union Ltd.

Your shares are withdrawable on demand, provided that they are not pledged against a loan. Members are encouraged to keep their savings intact thus ensuring that:

- the Member can maintain credit worthiness and capacity to borrow

- they continue to earn a dividend

- by leaving a balance of €250.00, you benefit from Life Savings Insurance protection

You can request your statement by a personal visit to the office. You have full access to your account by registering for online banking and you can print off estatements as you wish. To register click here

Effective since 01.12.2020, members cannot lodge funds above €20,000 in individual accounts held in the credit union.

Your name can easily be changed on your account. Just call into the office in person with evidence of your name change e.g. a marriage certificate. Staff will copy the certificate and then complete a change of name.

NOTE – Members updating names may also wish to update their form of nomination to take account of their change in circumstances.

Your address can easily be changed on your account. Just submit evidence of the change, e.g. a current (within the last 3 months) utility bill or bank statement Staff will copy your documents and then complete a change of address.

You may close your account at any time providing there is no loan outstanding on your account. Your photo ID must be presented and any remaining funds withdrawn.

Killarney Credit Union Ltd members complete a form of nomination whereby they can chose where their money will go in the event of their death.

A nomination is a written instruction to the Credit Union as to how to dispose of the contents of a Credit Union account, including insurance benefits, up to a maximum of €23,000, when the holder of the account dies. Any surplus above this figure is passed on to the Members’ estate. It is a legally binding document and is effective regardless of whether a will exists or not. A nomination may be revoked or altered by a subsequent nomination. Marriage invalidates an existing nomination.

Making a nomination is simple: - Visit the office and our staff will guide you through the process easily and without fuss. Once completed and duly witnessed, the Form of Nomination must be lodged in the Credit Union Office. Please Note The nominee or beneficiary is not allowed to witness the nomination. Before the property is transferred to the nominee, proof of death is required.

Why did I receive this letter?

You received this letter as you have not performed any account transactions on your account in the last 3 years and under Rule 22 of the Standard Rules for Credit Unions (ROI), regarding dormant accounts; dormant accounts are classified as any account which had no member transactions in the last 3 years.

You have three options.

With each of these options you must provide current / valid Photo ID (passport/driver’s license) and Proof of Address (utility bill/bank statement/government document less than six months old).

- You can reactivate your account by providing the required identification listed above and transacting on your account at any of our three credit union offices in Beech Road, Park Road or Kenmare.

- If you have moved from the area and you wish to transfer your account to a credit union in your area, you can contact your nearest credit union.

- You may wish to close your account by calling to the credit union offices.

No, your account has been classified as dormant. Your shares / savings are still in your account.

To re activate your account, simply call to any of our offices within the next 30 days with the following :

- Certified photographic ID (Passport, Driving Licence, National Identity Card, Public Services Card, Garda verified ID form (ML10) or Garda issued National Age Card)

PLUS

- Proof of address (original of recent household bill, house or motor insurance document, bank statement, letter from Revenue or other Govt Dept, local authority document dated within the past 3 months)

You will also need to transact (lodge or withdraw) on the account on the same day to finalise the re-activation.

You will also need to complete a new membership application and reactivation form.

Payments can be received from countries in the SEPA Zone only. There are 33 countries within the SEPA Zone, including the 28 EU member states and five other territories.

The 28 EU States:

Austria, Belgium, Bulgaria, Croatia, Cyprus, Czech Republic, Denmark, Estonia, Finland, France Germany, Greece, Hungary, Ireland, Italy, Latvia, Lithuania, Luxembourg, Malta, Netherlands, Poland, Portugal, Romania, Slovak Republic, Slovenia, Spain, Sweden and United Kingdom.

Other Territories:

Iceland, Liechtenstein, Monaco, Norway and Switzerland

Note: Payments can only be made and received in euro.

Currently payments can only be made to accounts held in Irish banks.

Yes, it is possible to make a payment from the UK to a Credit Union account. The important point for the member to remember is that the payment type must be a ‘SEPA Credit Transfer’ not an ‘International Payment’.

The member must stipulate that the payment to be made must be a ‘SEPA Credit Transfer’. The UK bank will convert the sterling debit on the UK account from sterling to euro and send the payment out as a ‘SEPA Credit Transfer’. The payment will be received into the member account in euro.

Similarly it is possible to receive pension payments from the UK for the credit of a member account- again the member must stipulate that the payment must be made as a SEPA Credit Transfer.

No, countries outside the SEPA Zone are not eligible to make SEPA payments.

If a member attempts to make a payment from a country outside the SEPA Zone, the originating bank should reject the payment. In some cases, the originating back may attempt to send the payment as an International SWIFT payment – in which case the payment will be returned when it reaches the destination country. It may take some days for the payment to be returned.

Currently no. This payment will be rejected immediately by CUSOP as the BIC and IBAN will not be reachable.

CUSOP has 2 outgoing file transfer cut-offs each working day.

| File cut off time | Settlement Date | Delivery time to other banks | Posting to account |

| 9.30 | Same day | By 16.00 | By close of business |

| 16.00 | Next day | By 9.00 (next day) | Morning next day |

Note 1: The ITSP may require to close out your files in advance of the CUSOP cut-off to allow time for file preparation and transmission.

Note 2: Posting to creditor account happens shortly after delivery to other Bank, but this time cannot be guaranteed.

There are two types of arrears, interest arrears and principle arrears.

Interest arrears is the amount of interest that has built up on your account since your last payment. Interest is accrued daily based on the loan balance. When a payment is missed, interest continues to accrue on the loan balance until the next payment is made. Where interest has accrued longer than the agreed repayment term, this is referred to as interest arrears.

Principle arrears When a loan is drawn down, the amount borrowed, interest rate, term and agreed level of payments are used to generate an “amortisation table”. This is effectively a plan as to how the loan is intended to be paid. When payments are missed the actual balance falls behind the point where the balance had “planned” to be at this point in the loan. This is referred to as principle arrears.

If you miss payments as per your agreement, interest will continue to accrue. That may lead to the interest figure growing to an amount that is greater than your repayment amount. When this occurs, your next payment will be applied against interest first. Once all interest arrears have been cleared the principle loan balance will reduce.

Arrears are the difference between where the loan balance should be and where it is. They have occurred because a repayment (repayments) have been missed. These missed payments have caused the arrears gap to be created. On resuming payments, a member can stop the gap growing, but the loan will still be in arrears. The only way to reduce the arrears is to increase your repayment to more than the amount originally agreed (gradually reduce arrears over time) or pay an amount equivalent to the missed payment together with any additional interest arrears (clear loan arrears in full)

Each time you transact with the credit union you receive a statement. The statement will contain the Loan Balance (Principle amount owed), the Interest balance outstanding (if applicable), and will show arrears or prepayments if applicable (prepayments are shown as arrears but are negative to reflect ‘negative arrears’). If you add the Loan balance plus the amount of interest outstanding you will get the total amount owed by you to the Credit Union.

As part of the Loan application process, Killarney Credit Union seek consent from members to access the Irish Credit Bureau for information relating to their credit history. As part of this consent members authorise us to share information about your loan with the bureau if it is granted. This information included the amount borrowed, and the up to date balance each month. When a loan falls into arrears this is reported to the ICB and a record of the arrears will appear on your Credit History for a period of 24 months after they are cleared.

Communication is key! We can only help if members engage, so if you find your circumstance have changed, and you are struggling to make the payments, call the Credit Control Department and they will review your updated circumstances and explain the options available.

The credit union is a community based organisation, and decisions on underwriting are made locally. Our underwriting criteria places the most emphasis on ability and willingness to repay. If you return to repaying your loan when your circumstances change for the better, it is this fact that will be remembered from your period with the credit control department. You will not be assessed based on missed payments when your circumstances deteriorated, you will be assessed on how you engaged and cooperated with the credit control process.

Make an appointment to meet with somebody from our Credit Control Department on 064 663 1344. We will assist you in completing the household budget if you are having trouble doing so and we may identify areas in which savings could be made. We will consider whether the changed circumstances are temporary or permanent in nature and will provide the appropriate options that are applicable to you.

Download the household budget form. This form will help members summarise their income and expenditure, their assets and liabilities. The summary gives a list of most of the common expenditures that members will have and need to prioritise. All figures should be brought to monthly equivalents (i.e. if your wages are weekly: Multiply by 52 and divide by 12 to get monthly figure). Only once you understand what you spend your money on can you prioritise and ensure that the important bills are met.